Michael

•June 19, 2025

Dubai's real estate market in 2025 presents investors and homebuyers with an unprecedented array of opportunities, but perhaps no decision carries more weight than choosing between off-plan and ready properties. This fundamental choice shapes not only your immediate financial commitment but also your long-term investment strategy, risk profile, and potential returns in one of the world's most dynamic property markets.

The distinction between these two property types extends far beyond simple timing considerations. Off-plan properties represent a strategic bet on Dubai's continued growth and development excellence, while ready properties offer immediate gratification and proven value propositions. Understanding the nuances of each option becomes crucial as Dubai's property market continues to evolve, with new regulations, developer innovations, and market dynamics reshaping the investment landscape.

Recent market data reveals compelling trends that make this decision even more critical. Off-plan properties currently dominate Dubai's sales market, representing 70.5% of all transactions as of April 2025, while ready properties command premium prices but offer immediate rental income potential. The choice between these options often determines whether investors achieve their financial goals or miss significant opportunities in Dubai's competitive real estate environment.

Dubai's property market recorded over AED 114.1 billion in transactions during Q1 2025 alone, with more than 42,000 real estate deals completed across off-plan and secondary markets. This exceptional performance, representing a 55.1% year-over-year increase in transaction volume, demonstrates the market's continued strength and investor confidence in Dubai's real estate sector.

This comprehensive guide examines every aspect of the off-plan versus ready property decision, providing data-driven insights, expert analysis, and practical strategies to help you make the optimal choice for your specific circumstances. Whether you're a first-time buyer, seasoned investor, or expatriate planning your Dubai property journey, understanding these fundamental differences will empower you to navigate Dubai's real estate market with confidence and precision.

Need help making the right decision?

Let's connect you with the right expert!

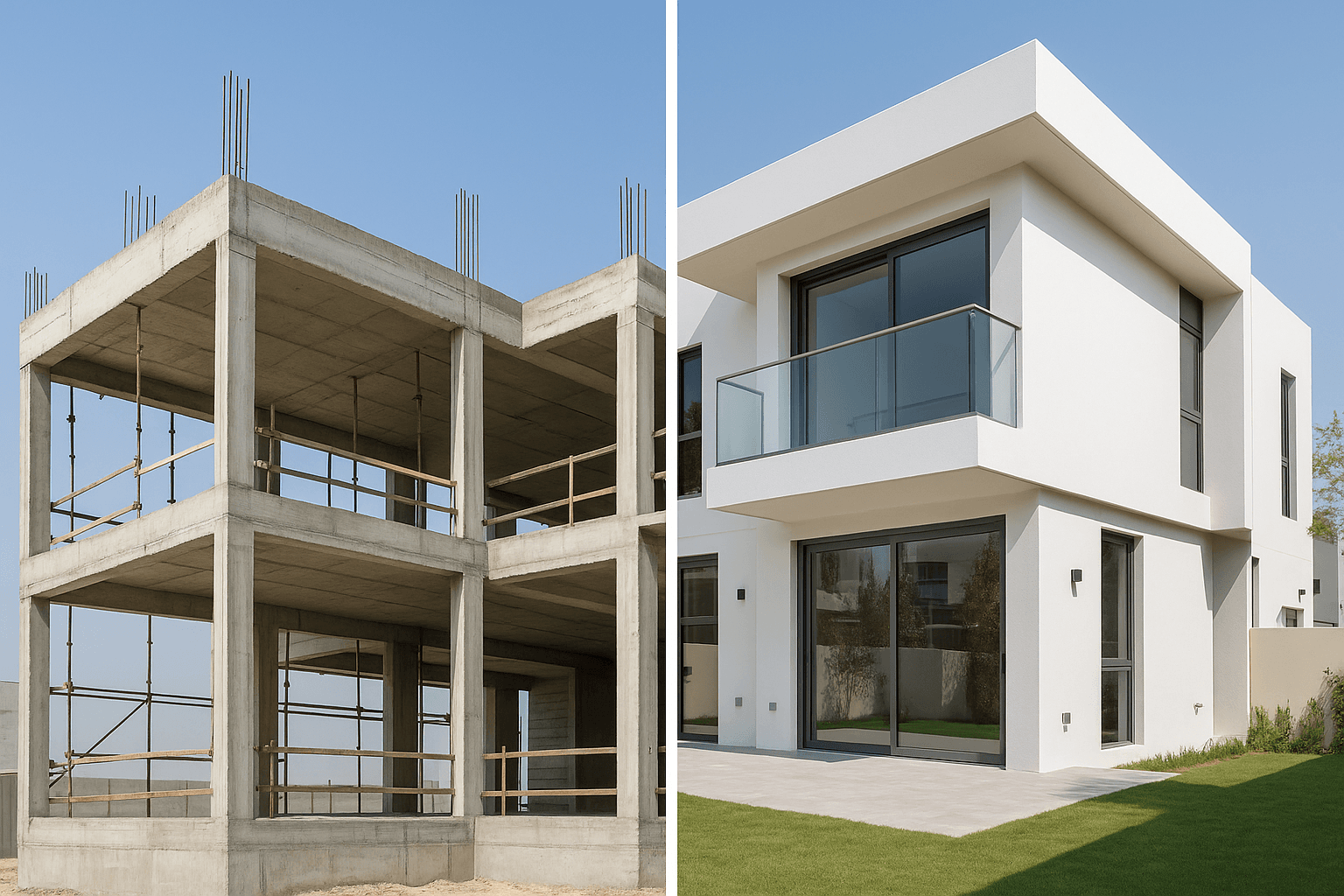

Modern off-plan developments showcase Dubai's commitment to innovation and quality construction standards

Off-plan properties represent one of Dubai's most distinctive investment opportunities, allowing buyers to purchase units directly from developers before construction completion. This investment approach has become synonymous with Dubai's rapid development and offers unique advantages that have attracted international investors for over two decades.

When you purchase an off-plan property, you're essentially buying a promise – a commitment from a developer to deliver a specific unit with defined specifications at a predetermined location. The transaction typically involves a reservation fee, followed by a structured payment plan that spreads your financial commitment across the construction timeline. Most developers offer payment plans ranging from 50-50 (50% during construction, 50% on handover) to 70-30 arrangements, with some extending to 80-20 for premium projects.

The off-plan market's dominance in 2025 is unprecedented, with off-plan sales accounting for AED 53.9 billion across nearly 25,000 transactions in Q1 2025 alone. This represents 70.5% of all market activity, demonstrating the continued appeal of off-plan investments among both local and international buyers.

The off-plan market in Dubai operates under strict regulatory oversight from the Real Estate Regulatory Agency (RERA), which mandates that all project funds be held in escrow accounts until completion. This regulatory framework provides investor protection while ensuring that developers maintain adequate financial resources to complete their projects. The escrow system represents a significant evolution from Dubai's earlier development phases and provides international investors with confidence in the market's stability and transparency.

Dubai's off-plan market has demonstrated remarkable resilience and growth, with major developers like Emaar, DAMAC, and Dubai Properties consistently delivering projects on schedule and to specification. Current market data shows that properties are selling faster than ever, averaging just 34 days on the market compared to 46 days in 2024, indicating strong demand and buyer confidence in off-plan offerings.

Ready properties offer immediate occupancy with premium finishes and established community amenities

Ready properties, also known as completed or resale properties, represent the traditional real estate investment approach where buyers acquire fully constructed, titled units that are immediately available for occupancy or rental. These properties have completed the development process, received all necessary approvals, and are ready for immediate use by their new owners.

The ready property market contributed AED 60.2 billion across approximately 17,500 transactions in Q1 2025, representing the secondary market segment that offers immediate value and proven performance. This substantial transaction volume demonstrates the continued appeal of ready properties among investors seeking immediate returns and end-users requiring immediate occupancy.

The ready property market in Dubai encompasses both newly completed units from developers and resale properties from individual owners. This market segment offers transparency and certainty that appeals to conservative investors and end-users who prefer to see exactly what they're purchasing before making their financial commitment. Ready properties come with established title deeds, completed community amenities, and proven rental markets that provide immediate income potential.

Dubai's ready property market benefits from the emirate's mature infrastructure, established communities, and proven track record of property value appreciation. Areas like Downtown Dubai, Dubai Marina, and Palm Jumeirah have demonstrated consistent performance over multiple market cycles, providing investors with confidence in long-term value retention and growth potential.

Current rental yields for ready properties range from 6-9% net annually, depending on the asset class and location. Premium neighborhoods like Downtown Dubai and Palm Jumeirah typically offer yields in the 5-8% range, while emerging areas provide higher yields that compensate for their developing infrastructure and amenities.

Q1 2025 residential market performance shows strong growth across all segments with current data from leading market analysts

The relationship between off-plan and ready property markets in Dubai reflects broader economic trends, developer strategies, and investor preferences. Current market data indicates that average property prices reached AED 1,565 per square foot in April 2025, representing a 1.97% monthly increase and positioning prices 26.9% above the previous market peak in September 2014.

This price performance reflects the market's fundamental strength and continued appeal to international investors. Foreign investor participation remains dominant at 58% of all residential transactions, with investors from India, Russia, Britain, China, and Germany leading the international buyer segment.

The rental yield differential between off-plan and ready properties also influences investment decisions. Ready properties generate immediate rental income, with average yields ranging from 6-9% annually across different areas and property types. Off-plan properties, while offering no immediate income, may provide superior total returns when capital appreciation during construction is factored into the calculation.

Market timing plays a crucial role in the off-plan versus ready property decision, particularly given the current market momentum. With monthly sales transactions hitting 18,010 in April 2025 – up 18.3% month-over-month and 55.1% year-over-year – the market demonstrates exceptional liquidity and investor confidence.

The current market environment is characterized by:

Need help making the right decision?

Let's connect you with the right expert!

Off-plan properties offer unparalleled financial advantages that make them particularly attractive for investors seeking to maximize their capital efficiency and long-term returns. The most immediate benefit lies in the significantly lower entry prices, with off-plan units typically priced 10-25% below comparable ready properties in the same area. This discount reflects the time value of money and construction risks, but for informed investors, it represents an opportunity to acquire premium real estate at substantial savings.

The payment plan structure of off-plan properties provides exceptional cash flow management advantages. Instead of requiring full payment upfront, developers typically offer structured payment schedules that spread the financial commitment across 18-36 months. A typical 50-50 payment plan requires only 10% reservation fee, followed by quarterly payments during construction, with the remaining 50% due on handover. This structure allows investors to deploy their capital gradually while potentially benefiting from property appreciation during the construction period.

For investors with limited initial capital, off-plan properties provide access to premium developments that might otherwise be financially out of reach. The ability to secure a unit with a relatively small initial payment, followed by manageable installments, democratizes access to Dubai's luxury real estate market. This accessibility has attracted international investors who can participate in Dubai's growth story without requiring substantial upfront capital commitments.

The capital appreciation potential during construction represents another significant financial advantage. Historical data from Dubai's real estate market shows that well-located off-plan properties often appreciate 15-30% between launch and handover, providing investors with substantial returns before they even take possession. Current market conditions, with prices rising 1.97% monthly and 26.9% above previous peaks, suggest continued appreciation potential for well-selected off-plan investments.

Off-plan properties consistently incorporate the latest technological innovations, design trends, and sustainability features that reflect evolving lifestyle preferences and regulatory requirements. Developers invest heavily in research and development to ensure their new projects meet or exceed international standards for smart home technology, energy efficiency, and modern living conveniences.

Smart home integration has become standard in most off-plan developments, with units featuring automated lighting systems, climate control, security monitoring, and energy management systems that can be controlled remotely via smartphone applications. These technological features not only enhance the living experience but also contribute to long-term property value and rental appeal, particularly among tech-savvy expatriate tenants who represent a significant portion of Dubai's rental market.

Sustainability features in off-plan properties align with Dubai's broader environmental initiatives and provide long-term cost savings for owners. Solar panel integration, energy-efficient appliances, water conservation systems, and sustainable building materials are increasingly common in new developments. These features reduce utility costs, qualify for green building certifications, and appeal to environmentally conscious tenants and buyers.

The design innovation in off-plan properties reflects contemporary lifestyle trends and space optimization techniques that maximize functionality and aesthetic appeal. Open-plan layouts, floor-to-ceiling windows, premium finishes, and flexible living spaces cater to modern preferences while ensuring that properties remain attractive to future buyers and tenants.

Developers often provide substantial incentives for off-plan buyers that enhance the overall value proposition beyond the base purchase price. These incentives may include waived Dubai Land Department (DLD) registration fees, complimentary furniture packages, guaranteed rental returns for initial periods, or flexible payment terms that further improve the investment economics.

The waiver of DLD fees, typically 4% of the property value, represents immediate savings of tens of thousands of dirhams for most purchases. When combined with other developer incentives, the total value of these benefits can significantly enhance the effective discount compared to ready properties, making off-plan purchases even more attractive from a financial perspective.

Some developers offer guaranteed rental return programs for off-plan buyers, providing income security during the initial years after handover. These programs typically guarantee 6-8% annual returns for 1-3 years, giving investors immediate income while the property establishes its market position and rental history. Such guarantees provide peace of mind and help investors plan their cash flows with greater certainty.

Flexible payment terms represent another valuable developer incentive, with some projects offering extended payment plans that stretch beyond handover or allowing buyers to customize their payment schedules based on their financial circumstances. This flexibility enables investors to optimize their cash flow management and potentially leverage other investment opportunities while maintaining their Dubai real estate exposure.

Off-plan properties enable sophisticated portfolio building strategies that would be difficult or impossible to implement with ready properties alone. The lower initial capital requirements and extended payment terms allow investors to acquire multiple units across different projects, locations, and price points, creating diversified real estate portfolios that spread risk while maximizing growth potential.

The ability to secure multiple off-plan units with relatively modest initial capital outlay enables investors to participate in various market segments simultaneously. An investor might acquire a studio apartment in Downtown Dubai, a one-bedroom unit in Dubai Marina, and a townhouse in an emerging community, creating exposure to different rental markets and appreciation potential while spreading their risk across multiple assets.

The timing flexibility of off-plan purchases allows investors to stagger their handover dates, creating a pipeline of properties that become available for rental or resale at different times. This staggered approach helps manage cash flow requirements and allows investors to benefit from market timing as different properties reach completion during various market conditions.

Off-plan investments also provide opportunities for pre-handover sales that can generate substantial returns without requiring full payment completion. Investors who identify promising projects early can potentially sell their purchase agreements to other buyers before handover, capturing appreciation while avoiding the full financial commitment and ongoing ownership responsibilities.

Need help making the right decision?

Let's connect you with the right expert!

While off-plan properties offer compelling advantages, they also carry inherent risks that require careful evaluation and mitigation strategies. Construction delays represent the most common risk, with projects occasionally experiencing extensions due to regulatory approvals, weather conditions, labor shortages, or design modifications. These delays can impact investor cash flows, particularly for those planning immediate rental income or specific move-in dates.

Historical data from Dubai's real estate market indicates that most reputable developers deliver projects within 6-12 months of their original timelines, with delays typically resulting from regulatory processes rather than construction issues. However, investors should plan for potential delays by maintaining financial flexibility and avoiding over-leveraging based on projected handover dates.

Quality control during construction represents another consideration, as buyers cannot inspect their units until near completion. Reputable developers maintain strict quality standards and provide regular construction updates, but variations in finishes or specifications can occur. Most purchase agreements include provisions for addressing quality issues, and Dubai's regulatory framework provides mechanisms for dispute resolution when necessary.

The regulatory environment provides substantial protection for off-plan buyers through escrow account requirements, RERA oversight, and developer licensing standards. All project funds must be held in designated escrow accounts that release payments to developers only upon achieving specific construction milestones. This system protects buyer investments and ensures that developers maintain adequate resources to complete their projects.

The success of off-plan investments depends heavily on developer selection, making due diligence a critical component of the investment process. Established developers like Emaar, DAMAC, and Dubai Properties have demonstrated consistent delivery capabilities and maintain strong financial positions that provide confidence in project completion.

Evaluating developer track records involves examining their historical delivery performance, project quality, and financial stability. Investors should review previous projects, delivery timelines, and customer satisfaction levels to assess developer reliability. RERA maintains public records of developer performance that provide valuable insights for investment decision-making.

Financial stability assessment includes reviewing developer balance sheets, project financing arrangements, and overall business health. Developers with strong financial positions and diversified project portfolios typically present lower risks than smaller developers or those heavily dependent on single projects for their financial viability.

The reputation and market positioning of developers also influence long-term property values and rental demand. Properties from prestigious developers often command premium prices and attract higher-quality tenants, contributing to superior investment performance over time. Brand recognition and developer reputation become particularly important in Dubai's competitive real estate market.

Off-plan investments carry market risk related to economic conditions, regulatory changes, and supply-demand dynamics that can affect property values between purchase and handover. Economic downturns, changes in visa policies, or shifts in expatriate employment patterns can impact demand for real estate and affect property values.

The extended timeline of off-plan investments means that market conditions at handover may differ significantly from conditions at purchase. While this timing can work in investors' favor during periods of appreciation, it can also result in properties being worth less than their purchase price if market conditions deteriorate.

Supply risk represents another consideration, particularly given the planned delivery of 210,000 units in 2025-2026, as multiple developers may launch competing projects in the same area, potentially affecting demand and pricing for individual developments. Investors should evaluate the total supply pipeline in their chosen areas to assess potential competition and market saturation risks.

Interest rate changes and financing availability can also impact off-plan investments, particularly for buyers planning to secure mortgages at handover. Changes in lending standards or interest rates between purchase and handover can affect financing options and overall investment returns.

The legal framework governing off-plan sales in Dubai provides substantial buyer protection, but investors should understand their rights and obligations under purchase agreements. Standard off-plan contracts include provisions for delivery timelines, quality standards, payment schedules, and dispute resolution mechanisms.

Purchase agreement terms vary among developers and projects, making careful contract review essential. Key provisions include penalty clauses for delivery delays, quality guarantees, payment schedule flexibility, and resale restrictions. Some contracts limit buyers' ability to sell their units before handover, which can affect liquidity and exit strategy options.

RERA registration requirements ensure that all off-plan projects meet regulatory standards and maintain appropriate buyer protections. Investors should verify that their chosen projects are properly registered and that developers maintain current licensing and compliance status.

The escrow account system provides the primary protection for off-plan buyers, ensuring that their payments are held securely until project completion. However, investors should understand the escrow release schedule and ensure that payments align with actual construction progress rather than arbitrary timelines.

Need help making the right decision?

Let's connect you with the right expert!

Ready properties provide the fundamental advantage of immediate income generation, allowing investors to begin earning rental returns from the moment of purchase completion. This immediate cash flow capability makes ready properties particularly attractive for investors seeking current income rather than long-term capital appreciation, and for those who require predictable returns to service mortgage payments or fund other investments.

Dubai's rental market demonstrates strong demand for quality ready properties, with current rental yields ranging from 6-9% net annually across different areas and property types. Premium locations like Downtown Dubai and Dubai Marina consistently attract high-quality tenants willing to pay premium rents for immediate occupancy, while emerging areas offer higher yields that compensate for their developing infrastructure and amenities.

The rental income from ready properties provides immediate cash flow that can be reinvested in additional properties, used to service debt, or applied to other investment opportunities. This income stream begins immediately upon tenant placement, typically within 30-60 days of purchase completion, providing investors with quick returns on their capital deployment.

Rental market dynamics for ready properties benefit from established community amenities, proven transportation links, and mature neighborhood characteristics that attract stable, long-term tenants. Expatriate professionals, who represent a significant portion of Dubai's rental market, often prefer ready properties in established communities where they can immediately assess lifestyle factors and community quality.

Ready properties offer complete transparency in the investment decision-making process, allowing buyers to inspect units, evaluate community amenities, and assess neighborhood characteristics before making their purchase commitment. This transparency eliminates the uncertainties associated with off-plan purchases and provides investors with complete information for their decision-making process.

Physical inspection capabilities enable buyers to evaluate property condition, finish quality, layout functionality, and view quality before purchase. This inspection process helps identify any maintenance requirements, upgrade opportunities, or potential issues that could affect rental appeal or resale value. Professional property inspections can reveal structural, mechanical, or cosmetic issues that might not be apparent during casual viewing.

Community assessment opportunities allow buyers to evaluate amenities, management quality, service charge levels, and overall community atmosphere. Established communities provide track records of management performance, maintenance standards, and resident satisfaction that help predict future living quality and property value trends.

The established rental market for ready properties provides clear data on achievable rental rates, tenant demand patterns, and occupancy levels. This market data enables accurate return calculations and helps investors set realistic expectations for their investment performance. Historical rental data also reveals seasonal patterns and market trends that inform rental strategy decisions.

Ready properties typically offer superior financing options compared to off-plan purchases, with banks generally providing more favorable terms, higher loan-to-value ratios, and faster approval processes for completed properties. The ability to conduct professional property valuations and inspections reduces lending risk from the bank's perspective, resulting in better terms for borrowers.

Mortgage availability for ready properties includes both local UAE banks and international lenders, providing buyers with multiple financing options and competitive interest rates. Local banks often offer preferential rates for ready property purchases, particularly for properties in established developments with proven track records and strong resale markets.

The valuation process for ready properties is straightforward and reliable, with professional appraisers able to conduct physical inspections and compare recent sales of similar units in the same development. This valuation certainty helps banks provide accurate loan amounts and gives buyers confidence in their purchase price relative to market value.

Faster mortgage processing for ready properties enables quicker transaction completion and reduces the risk of market changes affecting purchase terms. While off-plan purchases may require extended approval processes due to construction risks, ready property mortgages can typically be processed within 2-4 weeks, allowing buyers to capitalize on market opportunities quickly.

Ready properties in established communities benefit from mature infrastructure, proven amenities, and developed neighborhood characteristics that enhance both lifestyle quality and investment performance. These communities have demonstrated their appeal to residents and tenants over time, providing confidence in long-term desirability and value retention.

Infrastructure maturity in established communities includes completed road networks, utility systems, public transportation access, and commercial amenities that support daily living requirements. This infrastructure development eliminates the uncertainties associated with new communities where amenities and services may still be under development.

Community management systems in established developments have proven track records of service delivery, maintenance standards, and financial management. Buyers can evaluate historical service charge levels, reserve fund adequacy, and management company performance to assess ongoing ownership costs and community quality trends.

The social infrastructure of established communities, including schools, healthcare facilities, shopping centers, and recreational amenities, provides lifestyle benefits that attract quality tenants and support property values. These amenities represent substantial investments that enhance community appeal and provide competitive advantages in Dubai's rental market.

Ready properties benefit from established resale markets that provide liquidity and exit strategy flexibility for investors who need to adjust their portfolios or capitalize on market opportunities. The transparent pricing environment and established transaction processes make ready properties easier to value and sell compared to off-plan units with uncertain completion timelines.

Market liquidity for ready properties varies by location and property type, with premium areas like Downtown Dubai and Palm Jumeirah maintaining active resale markets that enable relatively quick transactions. This liquidity provides investors with confidence that they can exit their investments when market conditions are favorable or when their investment strategies change.

Professional valuation services for ready properties provide accurate market value assessments that help sellers price their properties competitively and buyers evaluate purchase opportunities. The availability of comparable sales data and professional appraisal services creates transparency that benefits all market participants.

The established legal framework for ready property transactions includes standardized contracts, proven title transfer processes, and established professional services that facilitate smooth transactions. This mature transaction environment reduces legal risks and provides certainty for both buyers and sellers in the resale market.

Need help making the right decision?

Let's connect you with the right expert!

Ready properties command premium prices compared to off-plan alternatives, reflecting their immediate availability, proven quality, and established market positioning. This price premium typically ranges from 10-25% above comparable off-plan units, representing a significant additional capital requirement that can impact investment returns and portfolio building strategies.

The higher acquisition costs for ready properties require larger initial capital commitments, potentially limiting investors' ability to diversify across multiple properties or markets. While off-plan properties enable portfolio building through lower down payments and extended payment terms, ready properties typically require substantial upfront investments that may constrain investment flexibility.

Financing requirements for ready properties, while generally more favorable in terms of availability and terms, still require significant down payments that can range from 20-25% for residents and 30-40% for non-residents. These capital requirements, combined with higher purchase prices, create substantial barriers to entry for investors with limited available capital.

The opportunity cost of deploying large amounts of capital in ready properties must be considered against alternative investment opportunities. The immediate capital commitment required for ready properties may prevent investors from participating in other opportunities that could provide superior returns or better risk-adjusted performance.

Ready properties, particularly those in the resale market, may require maintenance, upgrades, or renovations that add to the total investment cost and reduce immediate returns. While new ready properties from developers typically require minimal immediate maintenance, older properties may need significant investment to maintain their competitive position in the rental market.

Building systems and infrastructure in older ready properties may require updates or replacements that can be costly and disruptive. Air conditioning systems, plumbing, electrical systems, and building facades may need maintenance or upgrades that affect both investment returns and tenant satisfaction. These maintenance requirements should be factored into investment calculations and cash flow projections.

Interior finishes and fixtures in older ready properties may appear dated compared to contemporary off-plan developments, potentially affecting rental appeal and achievable rental rates. Upgrading kitchens, bathrooms, flooring, and fixtures can enhance rental performance but requires additional capital investment and careful cost-benefit analysis.

Community amenities in older developments may also require updates or enhancements to remain competitive with newer projects. Swimming pools, fitness centers, landscaping, and common areas may need renovation or modernization to maintain their appeal to quality tenants and support property values.

Ready properties offer limited opportunities for customization or personalization compared to off-plan purchases where buyers may have options to select finishes, layouts, or upgrade packages. This limitation can be particularly relevant for end-users who have specific preferences or requirements for their living spaces.

The fixed nature of ready property specifications means that buyers must accept existing layouts, finishes, and features, even if they don't align perfectly with their preferences or requirements. While modifications are possible after purchase, they require additional investment and may not be cost-effective compared to selecting preferred options during the off-plan phase.

Layout modifications in ready properties are often constrained by structural elements, building regulations, and community guidelines that limit the scope of possible changes. Major layout changes may require regulatory approvals and professional design services that add complexity and cost to the ownership experience.

The standardized nature of ready properties may limit their uniqueness or distinctive appeal compared to off-plan properties that offer customization options or unique design features. This standardization can affect both personal satisfaction for end-users and differentiation in the rental market.

Ready property purchases require immediate market timing decisions without the benefit of extended payment periods that allow off-plan buyers to average their market exposure over time. This immediate commitment can be disadvantageous if market conditions change shortly after purchase or if better opportunities emerge in the near term.

Valuation accuracy for ready properties, while generally more reliable than off-plan estimates, can still be challenging in rapidly changing markets where recent comparable sales may not reflect current conditions. Professional valuations provide point-in-time assessments that may not capture emerging market trends or changing demand patterns.

The immediate nature of ready property transactions may prevent buyers from taking advantage of market cycles or timing their purchases to coincide with optimal market conditions. Off-plan buyers can potentially benefit from purchasing during market downturns for delivery during recovery periods, while ready property buyers must transact based on current market conditions.

Market saturation risks in established areas may limit future appreciation potential for ready properties, particularly in mature communities where development opportunities are limited and supply growth is constrained. New off-plan developments may offer superior growth potential in emerging areas with significant development pipelines.

Need help making the right decision?

Let's connect you with the right expert!

Your investment timeline represents the most critical factor in choosing between off-plan and ready properties, as each option aligns with different time horizons and liquidity needs. Investors with long-term perspectives and patient capital often find off-plan properties more attractive, while those requiring immediate returns or shorter investment horizons typically prefer ready properties.

Long-term investors with 5-10 year investment horizons can capitalize on the full appreciation potential of off-plan properties, benefiting from both construction-period appreciation and long-term market growth. These investors can afford to wait for project completion and community maturation, potentially achieving superior total returns compared to ready property alternatives.

Medium-term investors with 2-5 year horizons face more complex decisions, as off-plan properties may not provide sufficient time for full value realization while ready properties may offer limited appreciation potential. These investors should carefully evaluate market cycles, project delivery timelines, and exit strategy options to optimize their investment approach.

Short-term investors or those requiring immediate liquidity should generally favor ready properties that provide immediate rental income and established resale markets. The liquidity advantages of ready properties become particularly important for investors who may need to adjust their portfolios quickly in response to changing circumstances or market opportunities.

Risk tolerance assessment plays a crucial role in the off-plan versus ready property decision, as each option presents different risk profiles that appeal to different investor types. Conservative investors typically prefer the certainty and transparency of ready properties, while aggressive investors may embrace the higher potential returns and risks associated with off-plan investments.

Conservative investors benefit from ready properties' immediate income generation, established market values, and proven performance track records. These investors prioritize capital preservation and predictable returns over maximum growth potential, making ready properties' stability and transparency particularly appealing.

Moderate risk investors may pursue balanced approaches that include both off-plan and ready properties, diversifying their exposure across different risk profiles and return potential. This diversification strategy can provide both immediate income from ready properties and growth potential from off-plan investments.

Aggressive investors often favor off-plan properties for their superior appreciation potential and capital efficiency advantages. These investors are willing to accept construction risks and delayed income in exchange for the possibility of achieving exceptional returns through well-timed off-plan investments.

Portfolio diversification considerations may influence the off-plan versus ready property decision based on existing holdings and overall investment strategy. Investors with predominantly off-plan portfolios may benefit from adding ready properties for immediate income and stability, while those with mainly ready properties might consider off-plan investments for growth potential.

Financial capacity assessment encompasses both available capital and ongoing cash flow requirements that influence the optimal choice between off-plan and ready properties. Investors with limited initial capital but strong ongoing income may prefer off-plan properties' extended payment terms, while those with substantial available capital might favor ready properties' immediate deployment opportunities.

Cash flow management becomes particularly important for off-plan investments, as buyers must maintain payment schedules throughout construction periods without receiving rental income. Investors should ensure they have adequate reserves to meet payment obligations even if their income situations change during the construction period.

Leverage strategies differ significantly between off-plan and ready properties, with ready properties generally offering superior financing options and terms. Investors planning to use significant leverage should carefully evaluate financing availability, terms, and requirements for each property type before making their investment decisions.

The total cost of ownership, including purchase price, financing costs, maintenance expenses, and management fees, varies between off-plan and ready properties and should be comprehensively evaluated. Off-plan properties may offer lower acquisition costs but require extended capital commitments, while ready properties provide immediate income but may require higher initial investments.

Market positioning considerations involve evaluating how off-plan versus ready properties align with current market conditions, supply-demand dynamics, and competitive landscapes in target investment areas. Understanding these market factors helps investors choose options that provide competitive advantages and superior return potential.

Supply pipeline analysis in target areas helps investors understand future competition and market saturation risks. Areas with limited off-plan supply may favor ready property investments, while areas with substantial development pipelines may offer attractive off-plan opportunities before increased competition affects market dynamics.

Demand pattern evaluation includes assessing tenant preferences, buyer behavior, and market trends that influence the relative attractiveness of off-plan versus ready properties. Some tenant segments prefer the latest amenities and features available in off-plan developments, while others prioritize the certainty and established communities associated with ready properties.

Competitive positioning involves understanding how off-plan and ready properties compete within specific market segments and price ranges. Premium market segments may favor off-plan properties with innovative features and prestigious developer brands, while value-oriented segments may prefer ready properties with proven performance and immediate availability.

The complexity of choosing between off-plan and ready properties makes professional guidance essential for optimal investment outcomes. Experienced real estate professionals can provide market insights, project evaluations, and strategic advice that significantly improve investment decision-making and risk management.

BrokeryHero connects investors with Dubai's most experienced real estate professionals who specialize in both off-plan and ready property markets. Our curated network of licensed brokers brings deep market knowledge, established developer relationships, and proven track records of delivering exceptional results for international investors.

Market analysis and due diligence services from qualified professionals help investors evaluate specific projects, developers, and market opportunities with greater accuracy and confidence. Professional insights can identify potential risks, highlight opportunities, and provide comparative analysis that individual investors might miss.

Transaction management and legal support ensure that off-plan and ready property purchases comply with all regulatory requirements and protect investor interests throughout the acquisition process. Professional guidance helps navigate complex contracts, financing arrangements, and regulatory procedures that can significantly impact investment outcomes.

Ongoing portfolio management and optimization services help investors monitor their investments, adjust strategies based on changing market conditions, and maximize long-term returns through professional property management and strategic decision-making support.

Need help making the right decision?

Let's connect you with the right expert!

Professional market analysis reveals that the optimal choice between off-plan and ready properties depends heavily on current market conditions, economic cycles, and individual investor circumstances. Experienced real estate professionals recommend a strategic approach that considers both immediate market opportunities and long-term investment objectives to maximize returns while managing risk effectively.

Current Market Conditions in 2025 favor selective off-plan investments in premium developments from established developers, while ready properties in mature communities offer stability and immediate returns. The market's strong fundamentals, including population growth, economic diversification, and infrastructure development, support both investment approaches when properly executed.

Market timing considerations suggest that mid-2025 presents attractive opportunities for off-plan investments in emerging areas like Dubai South and The Valley, where infrastructure development and government initiatives are driving long-term value creation. These areas offer the potential for significant appreciation as development plans materialize and communities mature.

Ready property opportunities in established areas like Downtown Dubai, Dubai Marina, and Palm Jumeirah provide immediate income generation and proven value retention, making them suitable for conservative investors or those requiring current cash flow. These areas benefit from mature infrastructure, established rental markets, and consistent demand from high-quality tenants.

Balanced Portfolio Approaches that combine both off-plan and ready properties often provide optimal risk-adjusted returns by capturing the benefits of each investment type while mitigating their respective limitations. Professional portfolio construction considers investor goals, risk tolerance, and market conditions to create diversified real estate holdings.

A typical balanced portfolio might include 60% ready properties for immediate income and stability, with 40% off-plan investments for growth potential and capital appreciation. This allocation provides current cash flow while maintaining exposure to Dubai's continued development and growth prospects.

Geographic diversification across different areas and communities helps spread risk while capturing various market dynamics and growth drivers. Combining investments in established premium areas with emerging communities provides exposure to both stable markets and high-growth potential areas.

Property Type Diversification across apartments, townhouses, and villas provides exposure to different tenant segments and market dynamics. Apartments typically offer higher rental yields and easier management, while villas appeal to family tenants and provide superior long-term appreciation potential.

Broker Selection Criteria should emphasize experience, market specialization, and proven track records in both off-plan and ready property transactions. The best real estate professionals bring deep market knowledge, established relationships, and comprehensive service capabilities that significantly enhance investment outcomes.

Licensed brokers registered with RERA provide assurance of professional standards and regulatory compliance, while specialization in specific areas or property types often delivers superior insights and access to exclusive opportunities. Experienced brokers can identify off-market opportunities, negotiate favorable terms, and provide ongoing market intelligence.

BrokeryHero's curated network of Dubai's top real estate professionals provides investors with access to the market's most experienced and successful brokers. Our platform connects investors with specialists who understand both off-plan and ready property markets, ensuring optimal guidance for every investment decision.

Professional credentials, client testimonials, and transaction history provide insights into broker capabilities and service quality. The most effective brokers maintain comprehensive market databases, established developer relationships, and proven track records of delivering exceptional results for their clients.

Comprehensive Risk Assessment should evaluate all potential risks associated with off-plan and ready property investments, including market risks, developer risks, regulatory risks, and economic risks that could affect investment performance. Professional risk management helps investors make informed decisions and implement appropriate protection strategies.

Insurance considerations include property insurance, rental guarantee insurance, and legal expense insurance that provide protection against various risks and potential losses. Professional insurance advice helps investors understand coverage options and select appropriate protection levels for their specific circumstances.

Legal Protection Strategies involve working with qualified legal professionals who specialize in Dubai real estate transactions and can provide contract review, due diligence support, and ongoing legal guidance. Professional legal support helps prevent problems and provides recourse options if issues arise.

Dispute resolution mechanisms and legal recourse options should be understood before making investment commitments, ensuring that investors know their rights and options if problems develop. Professional legal guidance helps navigate complex regulatory requirements and protect investor interests.

Strategic Exit Planning should be considered from the initial investment decision, ensuring that chosen properties align with long-term wealth building objectives and provide appropriate exit options when investment goals change or market conditions warrant portfolio adjustments.

Resale market analysis helps investors understand liquidity options and potential exit timelines for different property types and locations. Properties in established areas with active resale markets typically provide greater flexibility and faster exit options than those in emerging areas with limited transaction history.

Wealth Building Optimization involves leveraging Dubai's favorable tax environment, capital appreciation potential, and rental income opportunities to build long-term wealth through strategic real estate investment. Professional guidance helps investors optimize their strategies and maximize wealth building potential.

Tax planning considerations, including home country tax implications and Dubai's tax-free environment, should be evaluated with qualified tax professionals to ensure optimal after-tax returns and compliance with all applicable regulations.

The choice between off-plan and ready properties in Dubai represents one of the most important decisions in your real estate investment journey, with implications that extend far beyond immediate financial considerations. Both options offer compelling advantages when properly selected and executed, but success depends on aligning your choice with your specific goals, risk tolerance, and market understanding.

Off-plan properties provide exceptional opportunities for capital appreciation, portfolio building, and accessing premium developments at attractive prices. The extended payment terms, developer incentives, and modern features make off-plan investments particularly attractive for long-term investors with patient capital and growth-oriented objectives. However, these benefits come with construction risks, delayed income, and market timing considerations that require careful evaluation and professional guidance.

Ready properties offer immediate income generation, complete transparency, and proven performance that appeals to conservative investors and those requiring current cash flow. The ability to inspect properties, evaluate communities, and begin earning rental income immediately provides certainty and peace of mind that many investors value highly. The premium pricing and limited customization options represent trade-offs that must be weighed against these advantages.

The most successful investors often employ balanced approaches that capture the benefits of both investment types while mitigating their respective limitations. This strategic diversification provides immediate income from ready properties while building long-term wealth through carefully selected off-plan investments in emerging areas with strong growth potential.

Professional guidance becomes essential for navigating the complexities of Dubai's real estate market and making optimal investment decisions. The market's sophistication, regulatory requirements, and diverse opportunities require expertise that individual investors often lack, making professional support a critical success factor.

BrokeryHero connects you with Dubai's most experienced and successful real estate professionals who specialize in both off-plan and ready property markets. Our curated network of licensed, RERA-certified brokers brings the deep market knowledge, established relationships, and proven track records necessary for exceptional investment outcomes.

Whether you're drawn to the growth potential of off-plan investments or the stability of ready properties, the right professional guidance can significantly enhance your investment success while protecting your interests throughout the process. Connect with BrokeryHero's expert brokers today and discover how professional expertise can transform your Dubai real estate investment journey from complex and uncertain to strategic and profitable.

Need help making the right decision?

Let's connect you with the right expert!

Disclaimer: The content provided in this article is for informational purposes only and does not constitute legal, financial, or investment advice. The inclusion of any real estate agency, individual agent, or service is not an endorsement, recommendation, or guarantee of quality or performance. While we strive for accuracy, we do not warrant the completeness, reliability, or timeliness of any third-party ratings or awards mentioned.

Readers are encouraged to conduct their own research, consult with licensed professionals, and verify credentials or certifications directly with the Dubai Land Department (DLD) or appropriate regulatory bodies before making any real estate decisions.

BrokeryHero and the authors of this article disclaim any liability for decisions made based on the content herein.

Get the latest articles delivered every week.

By subscribing, you agree to receive blog updates. Unsubscribe anytime.

Feb 19, 2026

Feb 16, 2026

Feb 12, 2026

Feb 9, 2026

Feb 5, 2026

Feb 2, 2026

Feb 1, 2026

Jan 31, 2026

Jan 30, 2026

Jan 29, 2026