Michael

•October 2, 2025

In the world of high-stakes investment, a fundamental question persists: where should your capital be deployed for optimal returns? Do you place your faith in the tangible, income-producing security of real estate, or do you ride the volatile, high-growth wave of the stock market? This is not just a theoretical debate. For investors today, it's a critical decision that pits the stability of brick-and-mortar assets against the explosive potential of technological innovation.

This article provides a balanced, data-driven analysis of one of the world's most dynamic property markets—Dubai—against three of the most iconic stocks of our time: Apple (AAPL), Tesla (TSLA), and Amazon (AMZN). By examining their performance over a tumultuous ten-year period from 2015 to 2025, we offer a clear-eyed perspective to help you determine which asset class aligns with your financial goals.

Dubai's luxury real estate market offers tangible assets with consistent income generation

On one side, we have Dubai Real Estate, an asset class synonymous with luxury, growth, and a tangible store of value. It represents stability, consistent rental income, and a hedge against inflation.

Apple, Tesla, and Amazon represent the pinnacle of technology stock investment opportunities

On the other, we have the tech titans:

Apple (AAPL): The world's most valuable company, a beacon of consistent growth, brand loyalty, and market dominance.

Tesla (TSLA): The disruptor, a symbol of extreme volatility and astronomical growth, representing the high-risk, high-reward nature of innovative technology.

Amazon (AMZN): The e-commerce and cloud computing behemoth, a story of relentless expansion and market redefinition.

The past ten years have been anything but predictable, shaped by global economic shifts, a pandemic, and rapid technological advancement. Here's how our contenders fared.

Dubai's architectural marvels showcase the city's commitment to innovation and luxury living

The Dubai property market experienced a full and dramatic cycle. Following a peak in 2014, the market entered a multi-year correction phase from 2015 to 2020. Prices bottomed out in 2021, hitting a low of approximately 794 AED per square foot. This downturn, however, set the stage for a spectacular recovery. From 2021 to the end of 2024, prices surged by over 90%, reaching an average of 1,524 AED per square foot—a 51.9% increase from the 2014 baseline. This journey highlights the cyclical, yet resilient, nature of a mature property market.

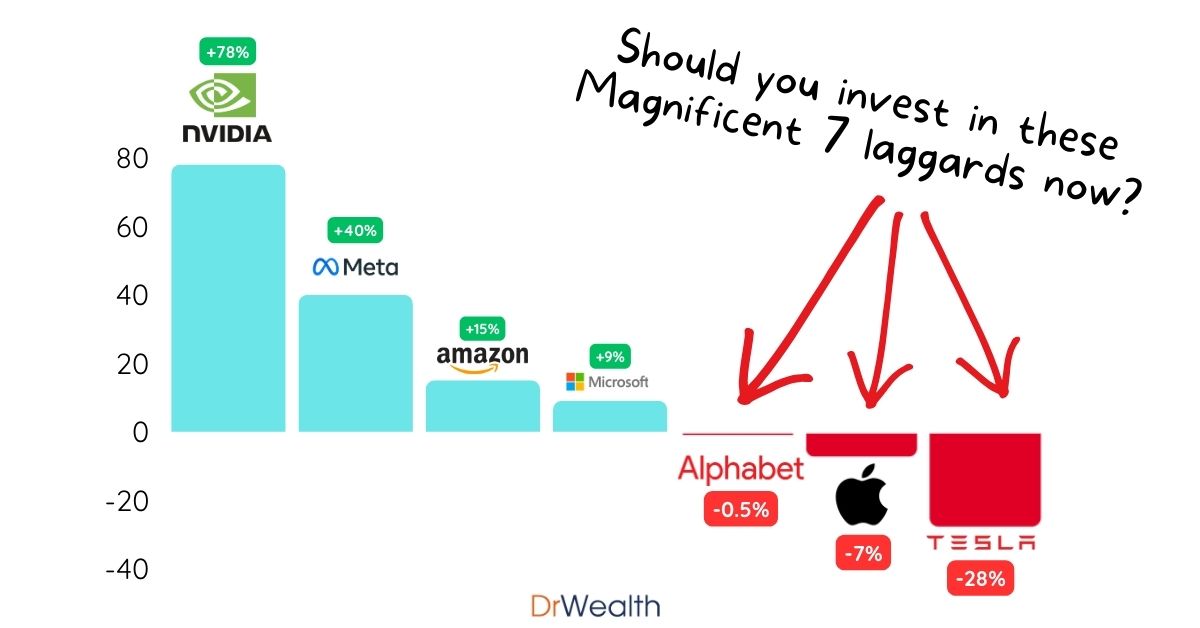

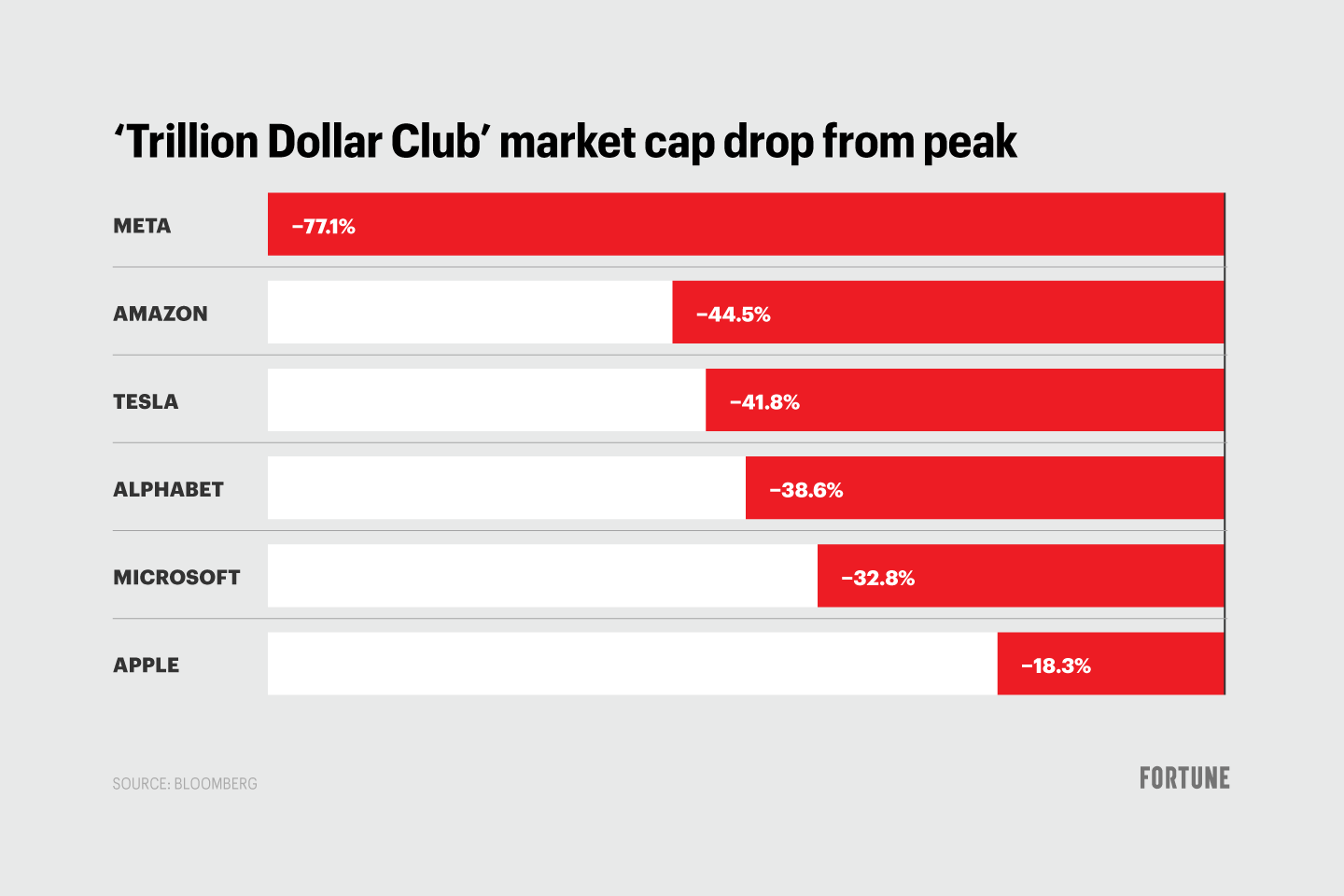

The dramatic rise and fall of tech stock valuations demonstrates the volatile nature of equity markets

The stock market, particularly the tech sector, told a story of explosive growth punctuated by sharp, heart-stopping corrections.

Apple (AAPL) was a model of relative consistency, delivering an average annual return of around 32%. Despite corrections in 2018 (-7.05%) and 2022 (-28.20%), its recovery was swift and powerful, with gains of +88.74% in 2019 and +78.24% in 2020.

Tesla (TSLA) was the wild card. It delivered a mind-bending 743.44% return in 2020 alone. This was followed by a brutal -65.03% crash in 2022, only to rebound with a +101.72% gain in 2023. Tesla's performance is the quintessential example of high-risk, high-reward investing.

Amazon (AMZN) started the decade with a bang, posting a +117.78% return in 2015. It followed a path of strong, steady growth before succumbing to the 2022 tech wreck with a -49.62% loss, but it too bounced back impressively in 2023 with an +80.88% gain.

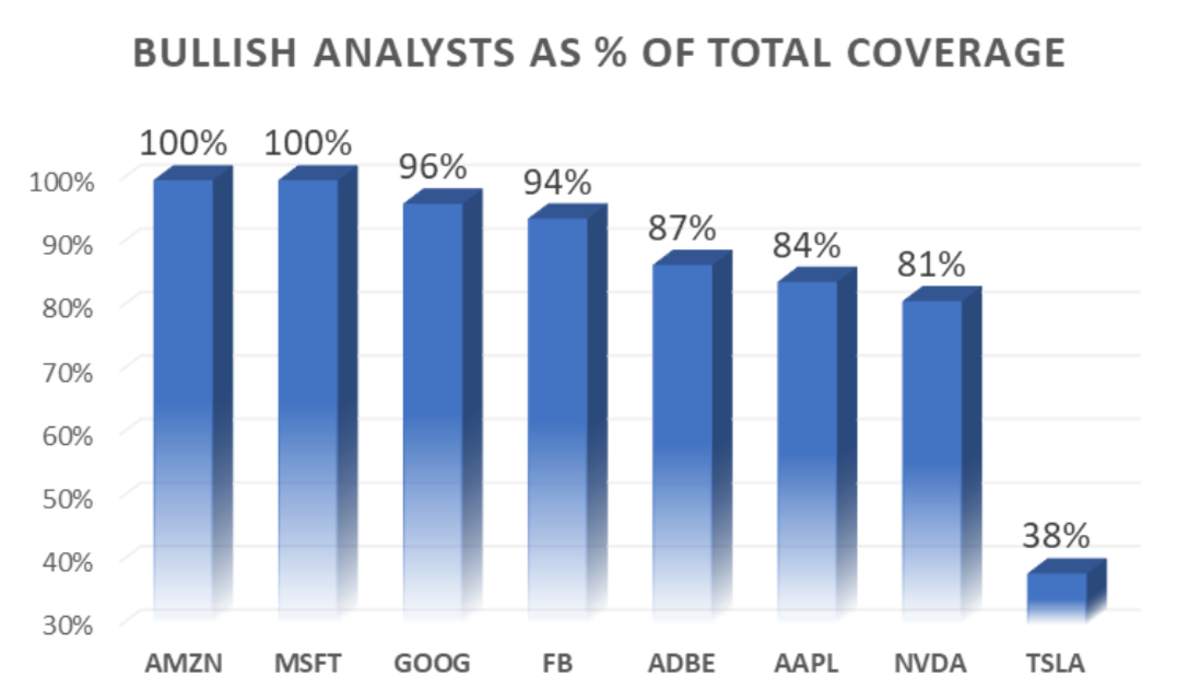

Wall Street analysts' perspectives on the three tech giants show varying levels of optimism

Let's break down the performance of these assets across key investment metrics.

There is no contest here: stocks delivered far superior capital gains. An investment in any of the three tech giants in 2015 would have yielded significantly higher returns than a property investment based purely on price appreciation.

Stocks: Cumulative returns for Apple, Tesla, and Amazon over the decade ranged from approximately 400% to over 1,000%.

Dubai Real Estate: Capital appreciation stood at 51.9% from the 2014 peak. However, this figure does not include rental income.

This is where real estate shines. Dubai properties consistently generate rental yields between 4% and 8% annually. Over ten years, this rental income significantly boosts the total return on investment, adding a layer of stability that stocks lack.

Dubai Real Estate: Provides a steady, predictable income stream.

Stocks: Apple and Amazon offer minimal dividend yields (often less than 1%), while Tesla pays no dividend at all. Stock investors rely almost entirely on capital gains.

The data clearly shows that stocks are vastly more volatile. While the potential for reward is higher, so is the risk of rapid, significant losses.

Stocks: Single-year losses were severe: -28% for Apple, -50% for Amazon, and a staggering -65% for Tesla. These are drops that can wipe out years of gains in a matter of months.

Dubai Real Estate: The correction was a slow, multi-year decline of around 20% in total. This gradual pace provides investors with more time to react and is far less psychologically taxing than a sudden market crash.

A property is a physical asset you can see, touch, and control. You can renovate it to increase its value or live in it yourself. This sense of ownership and control is a powerful psychological benefit that a stock certificate cannot offer.

Stocks are the clear winner in terms of liquidity. You can sell your shares and have cash in your account within days. Selling a property is a much longer process, typically taking 30 to 90 days, which makes it an illiquid asset.

The most sophisticated investors don't choose between real estate and stocks—they strategically combine both. This diversification approach offers several advantages:

Risk Mitigation: When stocks crash (as they did in 2022), real estate often provides stability. Conversely, when real estate markets correct, stocks can continue generating returns.

Income Plus Growth: Real estate provides steady cash flow through rentals, while stocks offer growth potential. This combination creates a balanced income and appreciation strategy.

Inflation Protection: Real estate historically outperforms during inflationary periods, while certain stocks (particularly technology companies with pricing power) can also maintain value.

After a decade of dramatic cycles, the data does not point to a single "winner," but rather to two different tools for two different jobs

Choose Dubai Real Estate if you are:

An Income-Focused Investor: The reliable rental yields provide a stable cash flow that stocks cannot match.

A Stability Seeker: The lower volatility and tangible nature of property offer peace of mind and a hedge against inflation.

A Portfolio Diversifier: Real estate's lower correlation to the stock market can help balance your overall portfolio and reduce risk.

Choose Tech Stocks if you are:

A Growth Chaser: You have a high-risk tolerance and are seeking maximum capital appreciation over the long term.

A Hands-Off Investor: You prefer a liquid investment that does not require active management like a rental property.

Ultimately, the most sophisticated investment strategy often involves a hybrid approach. A foundation of stable, income-producing real estate can provide the security to then take calculated risks in the stock market for higher growth potential.

Making the right investment decision requires more than just data—it requires expertise, market insight, and a strategy tailored to your personal financial goals. Whether you're looking to capitalize on Dubai's next property cycle or diversify your portfolio, professional guidance is invaluable.

Ready to build your investment strategy?

Connect with a verified investment specialist at BrokeryHero.com to get a personalized plan for the Dubai market. Our experts can help you navigate the complexities of real estate and find opportunities that align with your risk tolerance and financial ambitions.

Dubai Real Estate Data: Top Luxury Property, Dubai Land Department

Apple (AAPL) Stock Data: CompaniesMarketCap.com

Tesla (TSLA) Stock Data: SlickCharts, StatMuse

Amazon (AMZN) Stock Data: SlickCharts, StatMuse

Market Analysis: Forbes, Fortune, TheStreet

Disclaimer: The content provided in this article is for informational purposes only and does not constitute legal, financial, or investment advice. The inclusion of any real estate agency, individual agent, or service is not an endorsement, recommendation, or guarantee of quality or performance. Readers are encouraged to conduct their own research, consult with licensed professionals, and verify credentials or certifications directly with the Dubai Land Department (DLD) or appropriate regulatory bodies before making any real estate decisions.

BrokeryHero and the authors of this article disclaim any liability for decisions made based on the content herein.

Get the latest articles delivered every week.

By subscribing, you agree to receive blog updates. Unsubscribe anytime.

Feb 19, 2026

Feb 16, 2026

Feb 12, 2026

Feb 9, 2026

Feb 5, 2026

Feb 2, 2026

Feb 1, 2026

Jan 31, 2026

Jan 30, 2026

Jan 29, 2026