Michael

•October 7, 2025

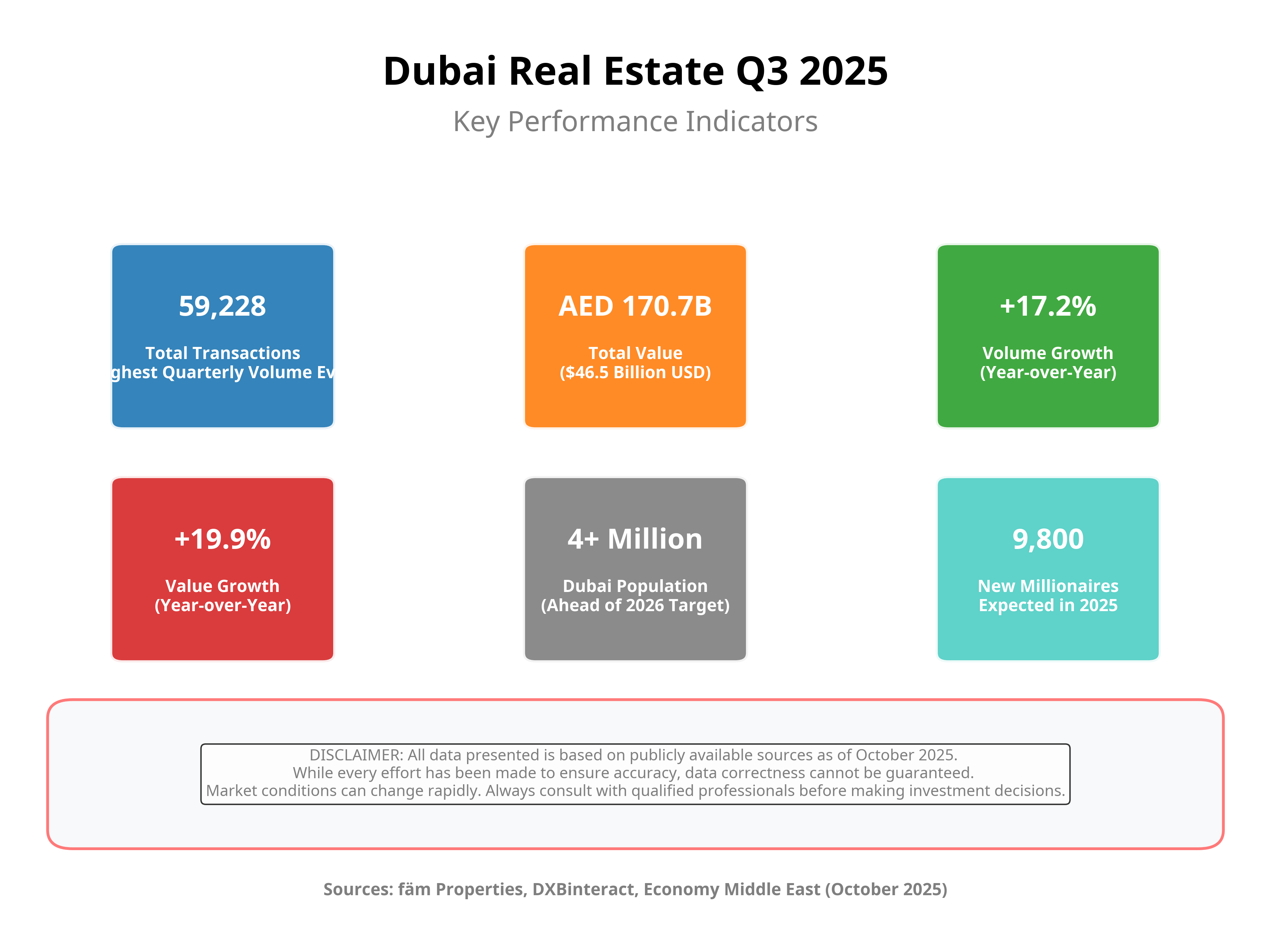

If you're considering buying property in Dubai right now, you're caught between two powerful narratives. On one hand, headlines flash warnings of an "elevated bubble risk" from respected financial institutions like UBS [1]. On the other, the market just shattered records with 59,228 transactions worth AED 170.7 billion ($46.5 billion) in Q3 2025 alone - the highest quarterly volume ever recorded [2].

So, what's the truth? Is this the perfect time to invest, or are you about to buy at the peak?

Comprehensive overview of Dubai's Q3 2025 real estate performance

This is not another generic market report. This is a buyer's reality check based on the most current October 2025 data. We'll cut through the noise, dissect the latest numbers, and give you the clear, balanced insights you need to make a smart investment decision in today's market.

Let's address the elephant in the room: the UBS Global Real Estate Bubble Index 2025. The report flagged Dubai for being at an "elevated bubble risk," placing it in the same category as cities like Los Angeles and Amsterdam.

The primary concerns cited are:

Price Acceleration Beyond Fundamentals: Property prices have nearly doubled since 2020, with median villa prices jumping from AED 858 per square foot to AED 1,685 per square foot in Q3 2025 [2]. This 96% increase in five years raises questions about sustainability.

Speculative Investment Patterns: The market shows signs of speculation, with 73% of transactions being first sales from developers versus only 27% resales in the secondary market [2]. This suggests buyers are betting on future appreciation rather than current value.

Supply Pipeline Concerns: New construction permits are climbing toward levels last seen in 2017, just before the previous market correction. With major projects delivering in 2026, oversupply remains a historical risk factor.

These are valid concerns that no serious buyer should ignore. However, this represents only one side of a complex equation.

While bubble warnings grab headlines, the Q3 2025 data tells a story of a market firing on all cylinders, driven by genuine economic fundamentals rather than pure speculation.

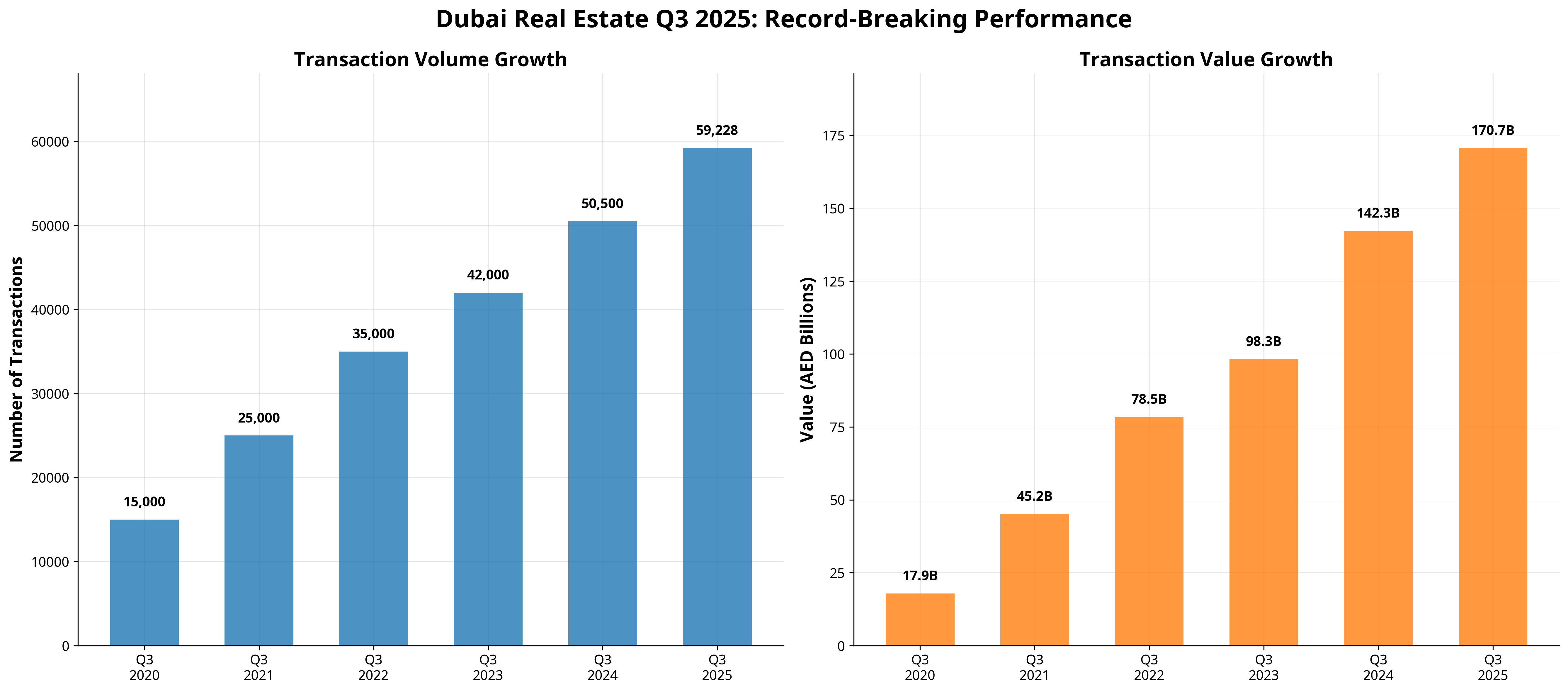

Five-year trajectory shows consistent growth culminating in record Q3 2025 performance

The third quarter of 2025 delivered the highest quarterly transaction volume in Dubai's history. With 59,228 sales transactions totaling AED 170.7 billion, the market achieved year-over-year growth of 17.2% in volume and 19.9% in value [2]. More importantly, the nine-month total for 2025 has already reached AED 498.8 billion ($136.1 billion) from 158,200 transactions - representing a 32.33% increase in value compared to the same period in 2024.

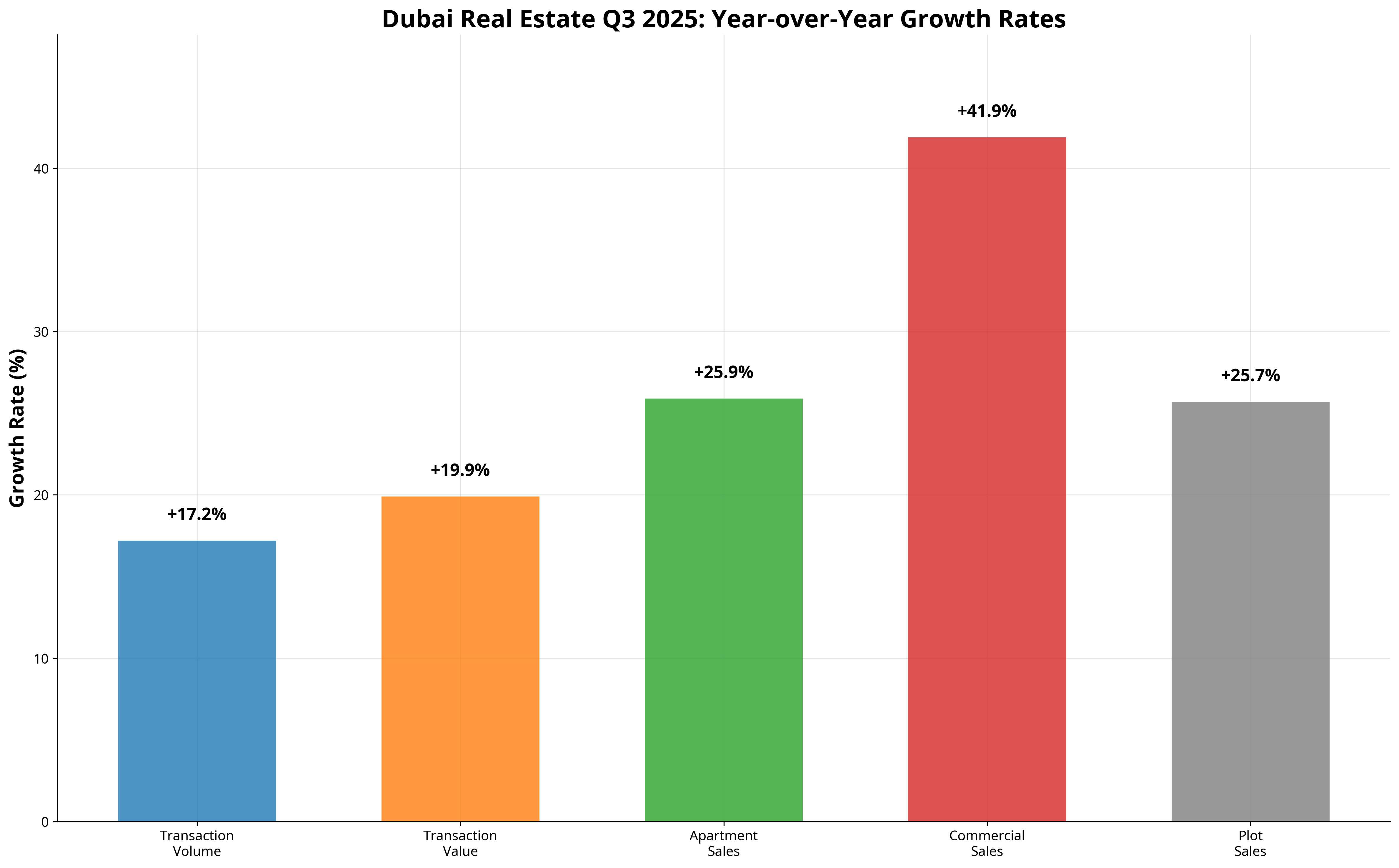

The growth isn't concentrated in one speculative segment.

Apartments led with 49,370 sales at AED 94.3 billion, showing 25.9% year-over-year volume growth.

Commercial sales soared 41.9% in volume to 1,565 transactions valued at AED 4.2 billion.

Plot sales climbed 25.7% in volume to 1,214 deals worth AED 36.1 billion [2].

Interestingly, while villa transaction volumes decreased 23.3% year-over-year, the median price per square foot rose 11.4% to AED 1,685, indicating quality over quantity in the luxury segment.

Consistent double-digit growth across all major property segments in Q3 2025

Dubai's population officially surpassed 4 million in August 2025, reaching a milestone originally projected for 2026 [2]. This isn't just a statistic - it represents genuine housing demand from real residents, not speculative investors. The city is attracting an estimated 9,800 new millionaires in 2025 alone, reinforcing its status as a global wealth magnet.

Moving to Dubai?

Check out our full move to Dubai guide with everything you have to know.

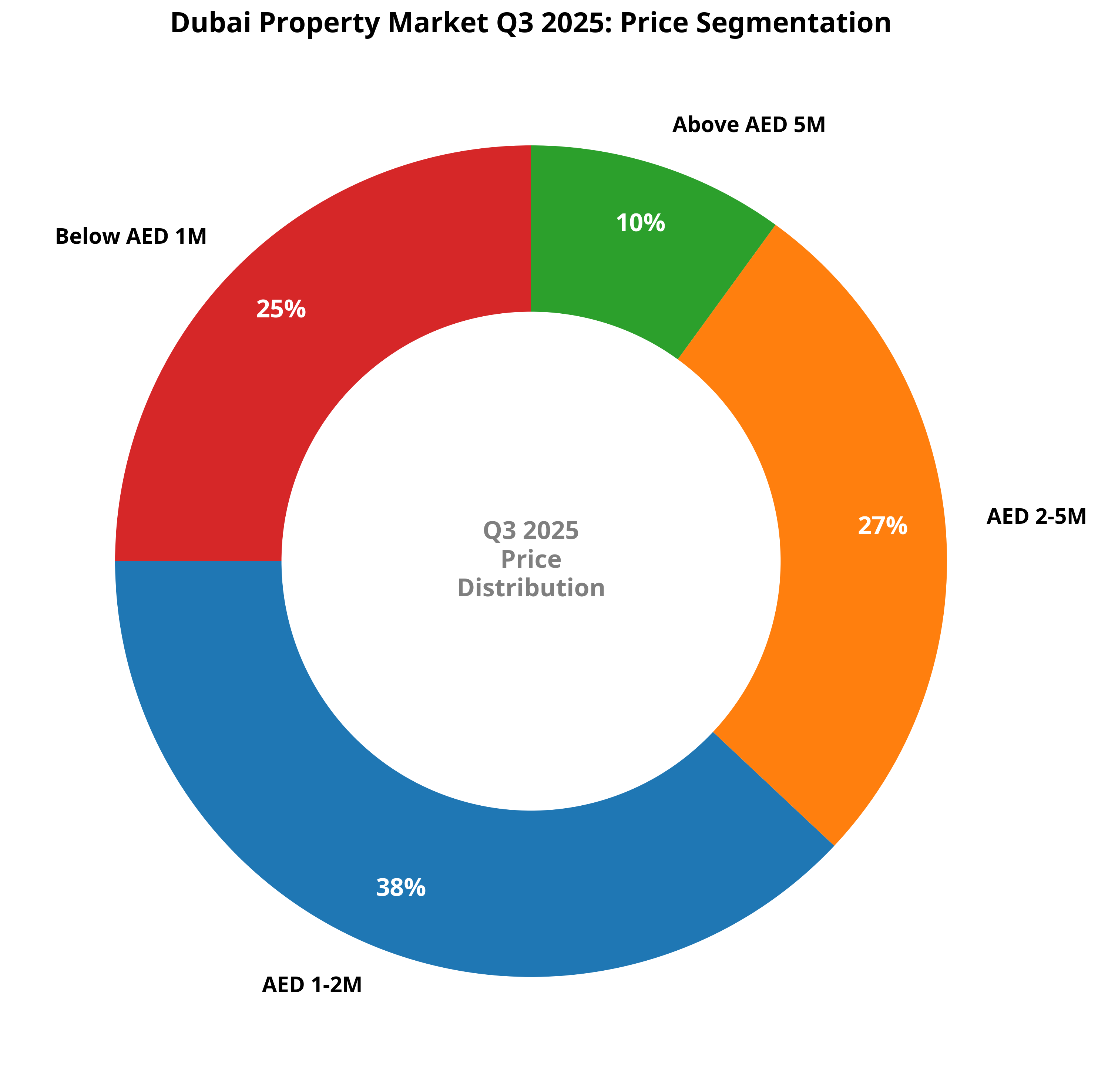

The latest Q3 2025 data reveals a more nuanced market than simple "bubble" or "boom" labels suggest.

The market shows healthy diversification across price ranges. Properties above AED 5 million account for only 10% of sales, while the bulk of activity occurs in the mid-market: 38% of sales fall between AED 1-2 million, and 25% are below AED 1 million [2]. This distribution suggests a market driven by genuine housing needs rather than pure luxury speculation.

The 73% to 27% split between developer first sales and resales indicates strong confidence in new developments and off-plan projects. However, this also means the secondary market remains relatively thin, which could impact liquidity for existing property owners.

The best-selling projects in Q3 2025 reveal market preferences. Binghatti Skyrise led apartment sales with 1,393 units at a median price of AED 1.5 million, while Wadi Al Safa 3 dominated villa sales with 849 units at a median price of AED 6.3 million [2]. These projects represent accessible luxury rather than ultra-high-end speculation.

Beyond market fundamentals, the UAE government has created powerful incentives that fundamentally alter the investment equation for international buyers.

By investing AED 2 million (approximately $545,000 USD) in property, international buyers can secure a 10-year renewable Golden Visa for themselves and their families [3].

This program provides:

Long-Term Residency Security: Unlike traditional visas tied to employment, the Golden Visa offers stability and independence.

Family Benefits: Sponsor your spouse, children, and even parents under the same program.

Tax Advantages: Benefit from the UAE's zero personal income tax policy.

Banking and Business Access: Easily establish financial relationships and business operations.

For many international buyers, the property investment becomes secondary to the lifestyle and security benefits of UAE residency.

The Dubai Land Department's First-Time Home Buyer Program, launched in July 2025, offers [4]:

Priority access to new project launches

Preferential pricing on select properties

100% refund on the 4% DLD registration fee

Improved financing options and tailored mortgage solutions

Developers have revolutionized property accessibility through innovative payment plans:

Ultra-Low Down Payments: Secure properties with as little as 10% down payment.

Construction-Linked Plans: Pay gradually during the building phase, reducing immediate financial pressure.

Post-Handover Options: Pay significant portions over 3-5 years after receiving keys and starting rental income.

So, is Dubai in a bubble? The data suggests something more nuanced than a simple yes or no. The market exhibits both genuine growth drivers and speculative elements. The key lies in understanding which segments and strategies align with sustainable fundamentals versus those driven by pure speculation.

The Growth Drivers Are Real:

Population growth exceeding projections

Economic diversification attracting global businesses

Government policy support through visa reforms

Infrastructure development enhancing connectivity

The Risks Are Also Real:

Price appreciation outpacing historical norms

High developer-to-resale ratio indicating speculative elements

Potential oversupply from 2026 deliveries

External economic vulnerability

Success in today's Dubai market requires strategic selectivity rather than market timing. Focus on:

Mid-Market Opportunities: The AED 1-3 million segment shows the strongest fundamentals and broadest demand base.

Established Locations: Areas with proven rental demand and infrastructure connectivity.

Reputable Developers: Track records of on-time delivery and quality construction.

Golden Visa Qualification: Properties that provide residency benefits alongside investment returns.

Flexible Payment Plans: Structures that minimize initial capital requirements while maximizing cash flow potential.

The difference between a smart investment and a costly mistake often comes down to having expert guidance. The current Dubai market rewards informed decisions and punishes speculation.

At BrokeryHero, we connect you with verified specialists who understand the nuances of today's market. Our experts can help you:

Identify genuine opportunities versus speculative plays

Navigate Golden Visa requirements and maximize residency benefits

Access off-market deals with optimal payment structures

Assess real risks specific to your investment profile

Build a strategy that aligns with both current conditions and long-term goals

Ready to make an informed decision in Dubai's record-breaking market?

Connect with a verified Dubai real estate specialist and turn market complexity into your competitive advantage.

[1] UBS Global Real Estate Bubble Index 2025

[2] Economy Middle East: Dubai real estate hits historic Q3 2025 milestone with 59,228 transactions, October 2025

[3] Dubai Land Department: Golden Visa application - Investor

[4] Dubai Land Department: First-Time Home Buyer Programme, July 2025

Disclaimer: The content provided in this article is for informational purposes only and does not constitute legal, financial, or investment advice. The inclusion of any real estate agency, individual agent, or service is not an endorsement, recommendation, or guarantee of quality or performance. Readers are encouraged to conduct their own research, consult with licensed professionals, and verify credentials or certifications directly with the Dubai Land Department (DLD) or appropriate regulatory bodies before making any real estate decisions.

BrokeryHero and the authors of this article disclaim any liability for decisions made based on the content herein.

Get the latest articles delivered every week.

By subscribing, you agree to receive blog updates. Unsubscribe anytime.

Feb 19, 2026

Feb 16, 2026

Feb 12, 2026

Feb 9, 2026

Feb 5, 2026

Feb 2, 2026

Feb 1, 2026

Jan 31, 2026

Jan 30, 2026

Jan 29, 2026